The 9-Minute Rule for Clark Wealth Partners

Wiki Article

The Best Strategy To Use For Clark Wealth Partners

Table of ContentsClark Wealth Partners for DummiesNot known Details About Clark Wealth Partners Not known Incorrect Statements About Clark Wealth Partners The Best Guide To Clark Wealth PartnersThings about Clark Wealth PartnersThe Facts About Clark Wealth Partners Revealed10 Easy Facts About Clark Wealth Partners Described

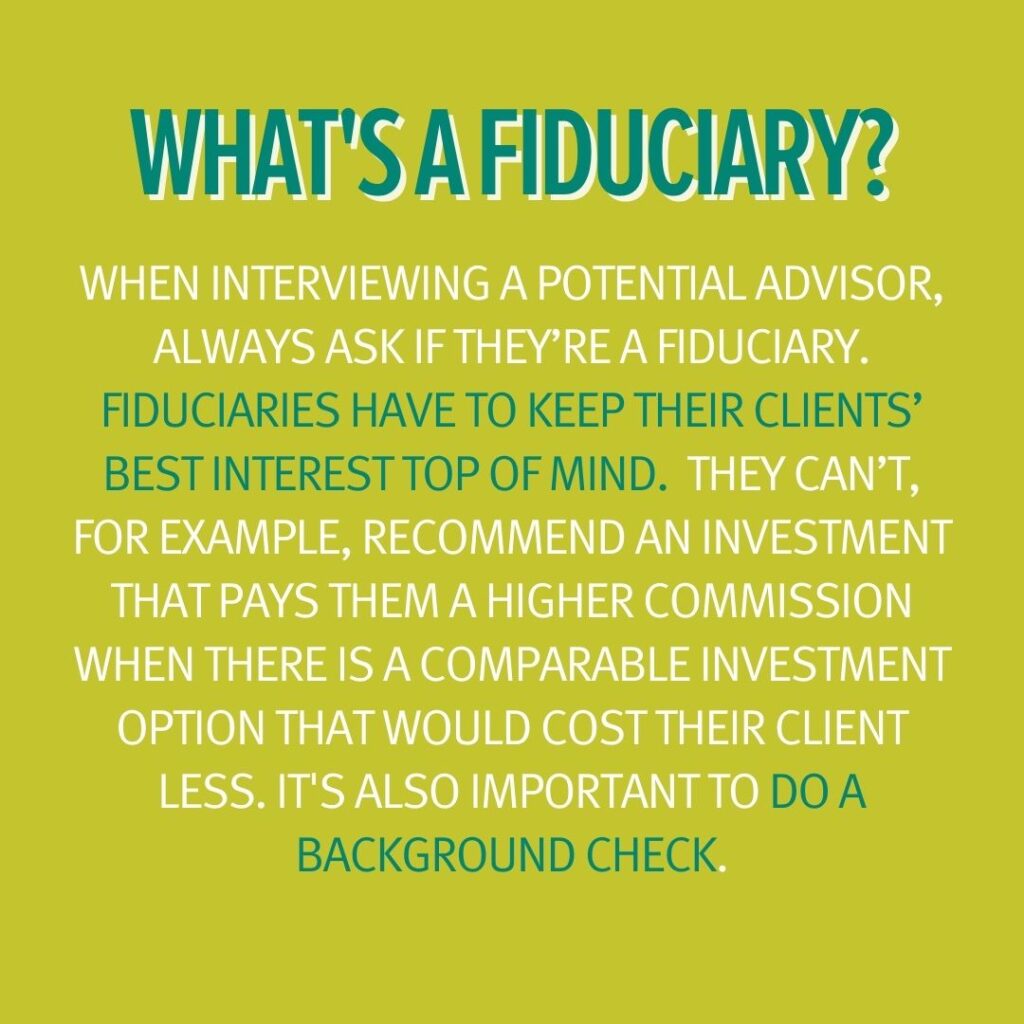

These are professionals that provide investment advice and are signed up with the SEC or their state's protections regulator. NSSAs can aid elders choose regarding their Social Safety benefits. Financial advisors can also specialize, such as in trainee financings, senior requirements, tax obligations, insurance and various other facets of your funds. The certifications needed for these specializeds can differ.However not always. Fiduciaries are lawfully needed to act in their client's ideal passions and to maintain their money and residential property different from other assets they take care of. Only economic experts whose classification requires a fiduciary dutylike qualified monetary coordinators, for instancecan say the very same. This difference also suggests that fiduciary and monetary advisor cost structures differ also.

Not known Details About Clark Wealth Partners

If they are fee-only, they're a lot more most likely to be a fiduciary. If they're commission-only or fee-based (indicating they're paid using a combination of charges and compensations), they may not be. Many credentials and designations require a fiduciary obligation. You can check to see if the professional is registered with the SEC.

Selecting a fiduciary will guarantee you aren't guided towards certain investments because of the compensation they provide - financial advisor st. louis. With great deals of money on the line, you may want an economic professional that is legitimately bound to utilize those funds carefully and only in your ideal passions. Non-fiduciaries may suggest financial investment items that are best for their pocketbooks and not your investing goals

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Rise in cost savings the typical home saw that functioned with a monetary advisor for 15 years or more contrasted to a comparable home without a financial advisor. "Extra on the Value of Financial Advisors," CIRANO Project Information 2020rp-04, CIRANO.

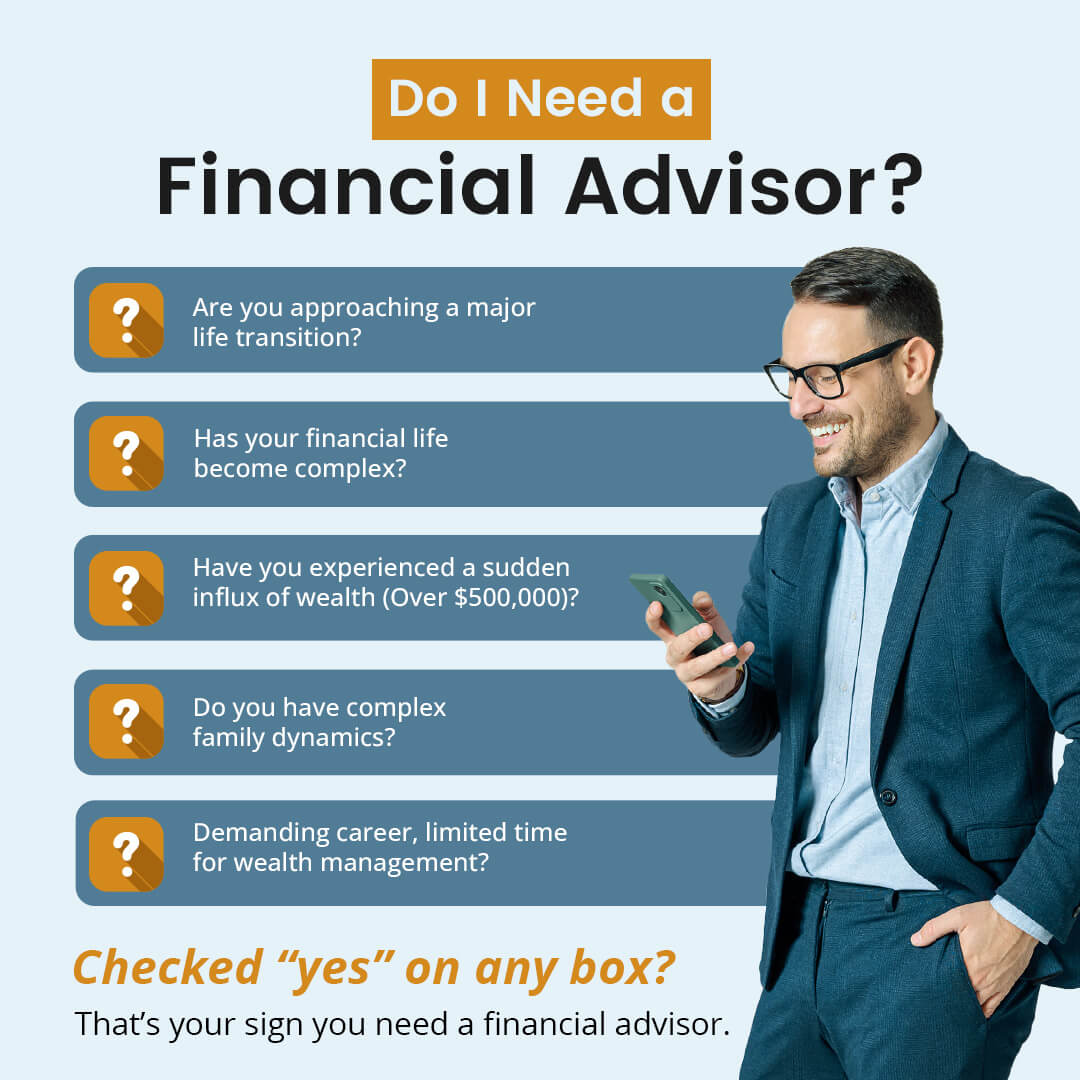

Financial advice can be beneficial at turning factors in your life. Like when you're beginning a household, being retrenched, planning for retired life or managing an inheritance. When you satisfy with an adviser for the very first time, function out what you intend to receive from the advice. Before they make any kind of recommendations, a consultant ought to put in the time to discuss what is essential to you.

The Best Strategy To Use For Clark Wealth Partners

Once you've agreed to go in advance, your financial advisor will prepare a monetary strategy for you. You must always feel comfortable with your advisor and their suggestions.Firmly insist that you are informed of all deals, and that you receive all document associated to the account. Your advisor may suggest a taken care of discretionary account (MDA) as a way of managing your investments. This includes signing an agreement (MDA agreement) so they can get or offer financial investments without needing to contact you.

Some Known Facts About Clark Wealth Partners.

Before you spend in an MDA, contrast the advantages to the prices and risks. To safeguard your cash: Don't provide your consultant power of attorney. Never sign a blank record. Put a time frame on any type of authority you provide to deal financial investments in your place. Firmly insist all document about your investments are sent out to you, not just your adviser.If you're relocating to a new consultant, you'll need to arrange to move your financial records to them. If you require assistance, ask your advisor to clarify the procedure.

To load their shoes, the country will require more than 100,000 new monetary consultants to enter the market.

Some Ideas on Clark Wealth Partners You Need To Know

Aiding individuals achieve their economic goals is a financial consultant's main feature. But they are also a small company owner, and a part of their time is dedicated to managing their branch workplace. As the leader of their method, Edward Jones monetary experts need the leadership abilities to work with and take care of team, along with business acumen to produce and implement an organization technique.Financial experts invest some time on a daily basis watching or reading market information on tv, online, or in profession magazines. Financial advisors with Edward Jones have the benefit of home workplace research teams that help them keep up to date on stock recommendations, shared fund administration, and extra. Investing is not a "collection it and forget it" activity.

Financial consultants should set up time each week to fulfill brand-new individuals and overtake individuals in their ball. The financial solutions market is heavily controlled, and guidelines alter usually - https://www.reddit.com/user/clrkwlthprtnr/. Numerous independent monetary consultants invest one to two hours a day on conformity tasks. Edward Jones financial experts are lucky the home office does the hefty lifting for them.

Everything about Clark Wealth Partners

company website Edward Jones monetary experts are encouraged to pursue additional training to broaden their understanding and abilities. It's additionally an excellent concept for financial advisors to attend market conferences.Report this wiki page